Lender, HUD Consultant, Contractor and a FHA203K

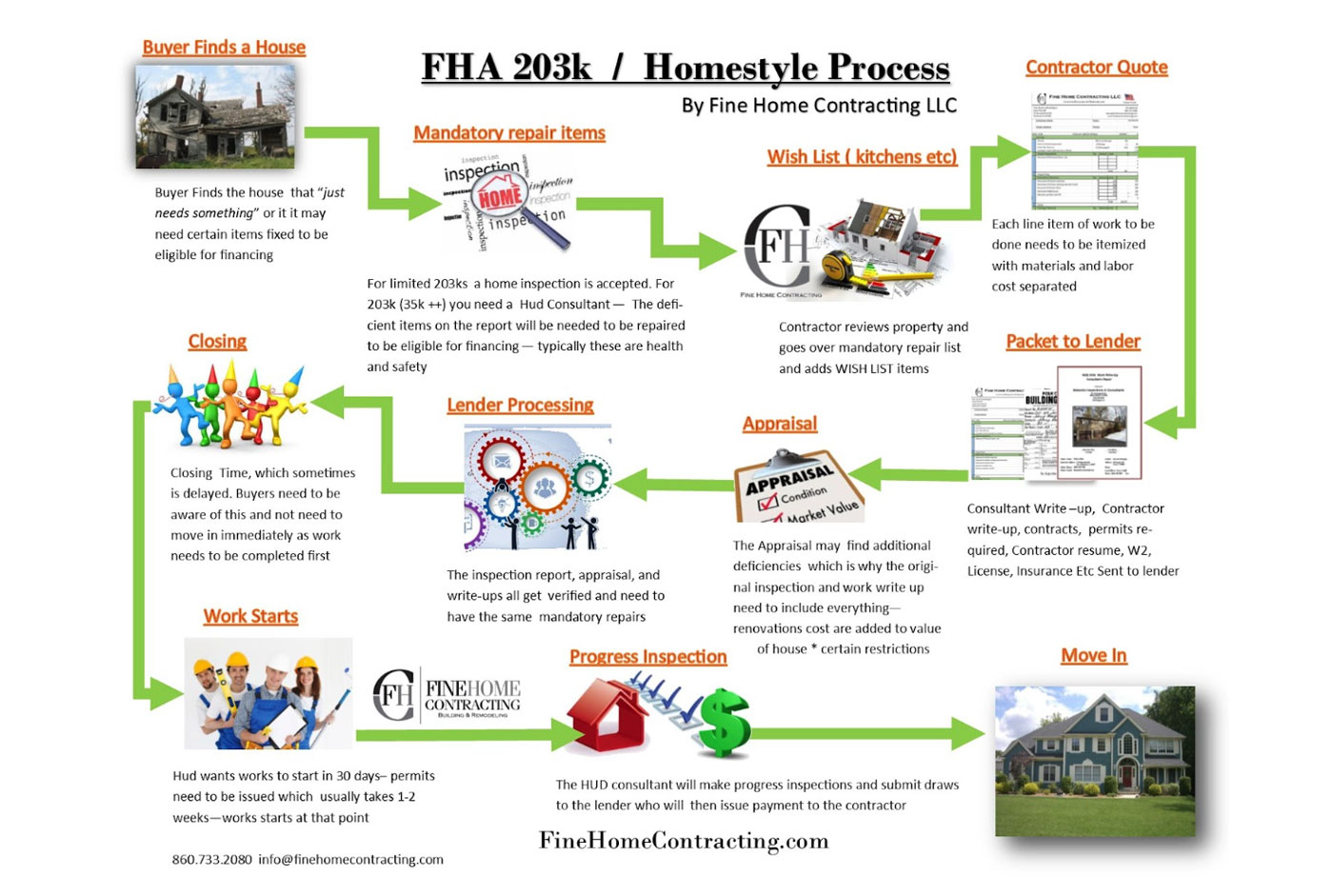

A FHA 203k renovation loan in Connecticut is a complex process that involves multiple players, including the lender, HUD consultant, and contractor. Understanding how these three parties work together is critical to a successful renovation project. In this blog, we will take a closer look at how the lender, HUD consultant, and contractor collaborate to make your renovation project a success.

- Lender: The lender is the first party involved in the process. They are responsible for evaluating your financial situation and determining if you are eligible for a FHA 203k loan. They will also work with you to determine the amount of money you need to finance your renovation project.

- HUD Consultant: The next party involved is the HUD consultant. They are responsible for reviewing the scope of your renovation project and ensuring that it meets all the requirements set forth by the Department of Housing and Urban Development (HUD). They will also help you create a detailed scope of work and provide you with a cost estimate.

- Contractor: The contractor is the final piece of the puzzle. They are responsible for executing the renovation project according to the scope of work approved by the HUD consultant. They will also be responsible for keeping the project within budget and on schedule.

In conclusion, the lender, HUD consultant, and contractor are critical players in the FHA 203k renovation loan process in Connecticut. They work together to ensure that your renovation project is a success, from start to finish. It’s important to work closely with each of these parties and communicate openly and regularly to ensure that your renovation project runs smoothly and meets all your needs and expectations.

As the leader in FHA203ks and a certified contractor, reach out to Fine Home Contractor for the best lenders and hud consultant that work across the state of Connecticut.